Backdrop

Surprisingly strong employment numbers. EV tax credits future skepticism. Car margins shrinking. Market down days might need a break.

Daily Chart

Flat day with slight upward bias after 5 prior downward days.

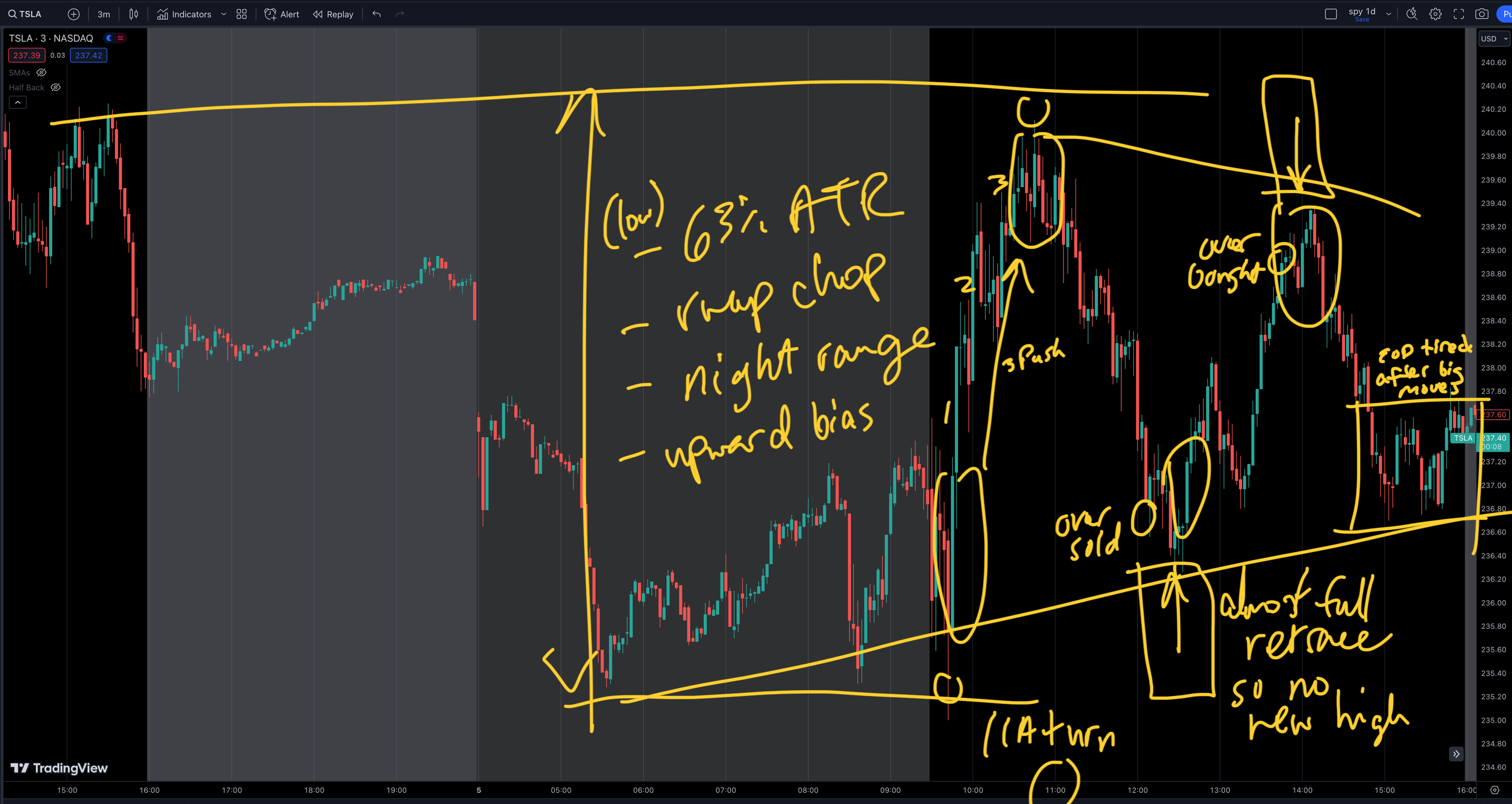

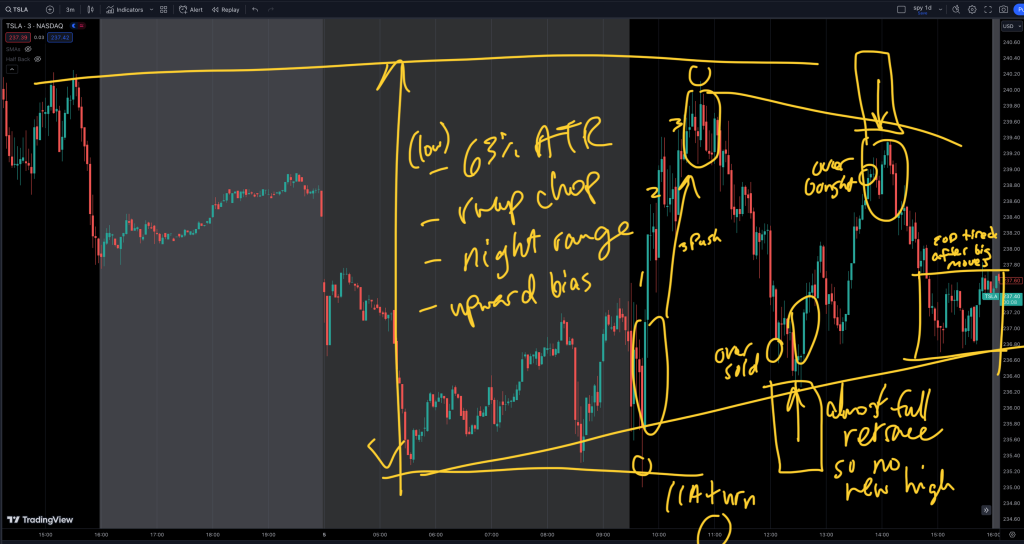

3-Minute Chart

4 good swings followed by flat close. Consolidating price stayed within the night range, with low daily range at 63% of ATR. VWAP chop. Slight upward bias.

Open was rangy. Eventually a big green bar happened. Direction turned in the first 2 hours. Price retraced almost to lows. New high unlikely, and indeed didn’t happen. Turned out to be a rangy day. By end of day, the price was done with big moves.

Strategy

Play the night range. Night zone is a magnet on low range days. Wait for confirmation patterns following RSI extremes. Stop on strength outside of night range. Maybe don’t short a slow market.

Happy trading.

(This post is for entertainment purposes and is not investment advice. You can lose money in the stock market.)