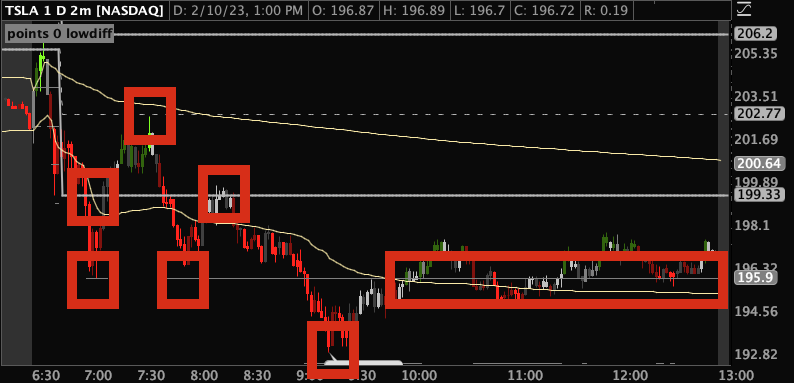

The expectation was, with yesterday’s strong directional movement, for the day to range. Instead it beat yesterday, having a somewhat strong downward direction, hovering below $200, with a range of 110% ATR. Volume 203 million.

The open was a gap down. On the 2-minute, it popped and rejected off the 20 SMA, then consolidated and dropped the same distance before bouncing.

Some nice early legs down were happening.

There was only one directional bar on the 15 minute chart. It happened after morning ranging, later at 7:45AM. It successfully hit the 1:1 target at 9:15AM. Price drifted up from there.

On the 15 minute chart, price mostly stayed below the 20 SMA and along the VWAP -1 standard deviation and the first extension of the first 15 minutes.

The double bottom of 8AM became a bear flag and broke down at 9AM.

The range of the first 15 minutes again influenced the bounces. First there was a breakdown at 7AM. At 7:08AM price bounced off the 1st extension to the mid level, then back to the 1st extension, then to the bottom of the range, then to the 2nd extension, then stayed around the 1st extension.

We could say there were 3 downs and 3 ups.

The downward direction was a contrast to the market, which very slowly drifted upward.

Maybe tomorrow will be a tighter range. Maybe a rebound up over $200.